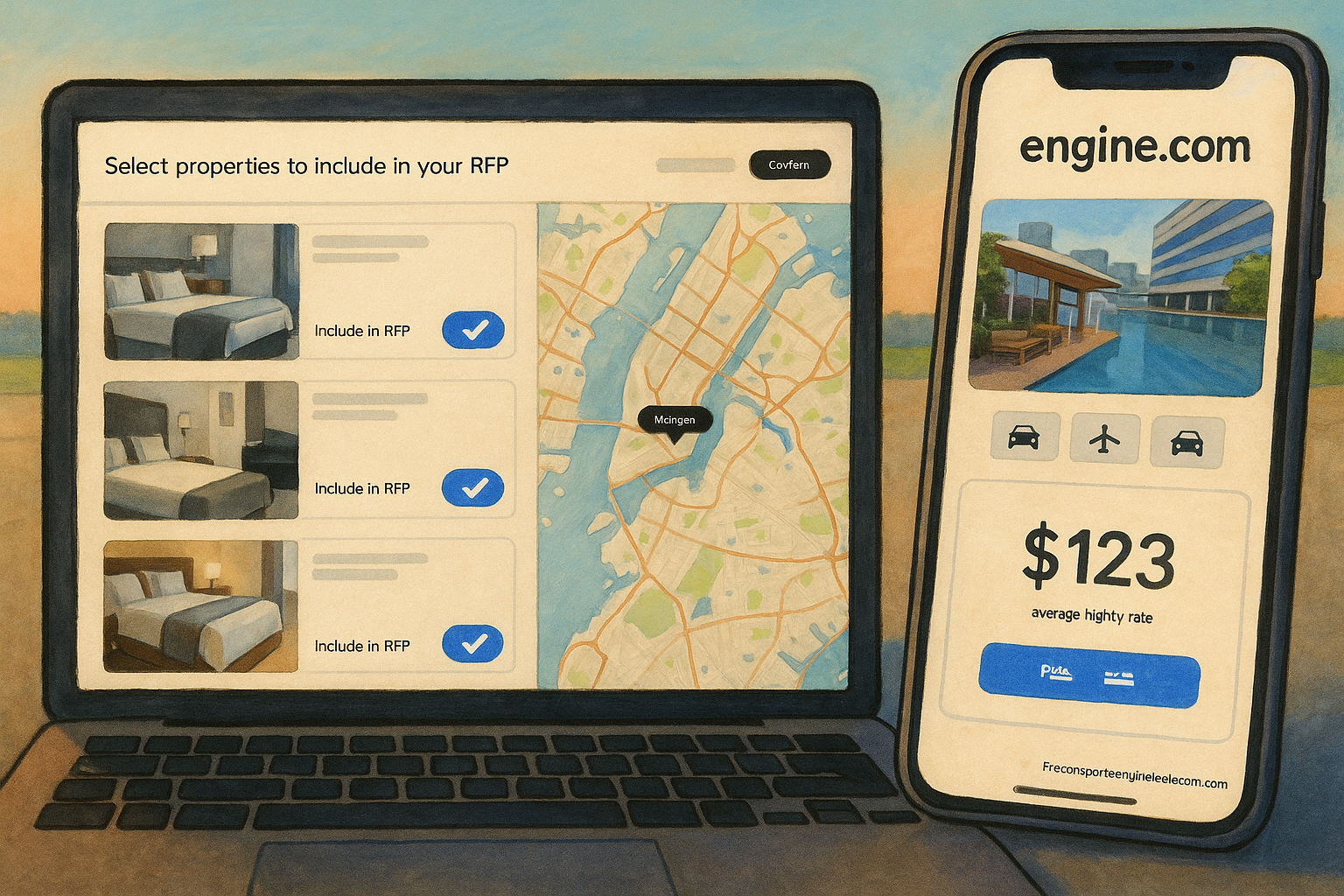

How pricing strategy boosted Engine.com’s margin and revenue

Overview

Engine.com revolutionized its financial performance through an advanced contextual dynamic pricing strategy that managed $2 billion in gross revenue volume. By implementing personalized pricing algorithms and innovative rebooking capabilities, the company achieved significant margin improvements while maintaining competitive positioning in the market. This strategic initiative was led directly under CEO Elia Wallen and VP of Data Science Chris Pouliot, demonstrating the critical importance of pricing optimization at the executive level.

Challenges Addressed

The primary challenge was optimizing pricing across a massive revenue base while balancing customer satisfaction and profitability. Traditional static pricing models were leaving money on the table and failing to respond to real-time market conditions. The company needed a sophisticated system that could process vast amounts of data, understand customer behavior patterns, and adjust pricing dynamically without alienating price-sensitive segments. Additionally, cost of goods sold (COGS) optimization required a new approach to inventory management and rebooking strategies.

Technical Approach

The solution centered on custom machine learning models that enabled contextual dynamic pricing and personalized pricing strategies. The team developed algorithms that analyzed customer behavior, market conditions, demand patterns, and competitive positioning in real-time. A key innovation was the rebooking capability that optimized COGS by intelligently managing inventory allocation and pricing adjustments. The system processed multiple data streams simultaneously, including historical purchase data, real-time demand signals, and external market factors to generate optimal pricing recommendations.

Impact

The pricing strategy delivered measurable results with a 30 basis points (BPS) uplift confirmed through rigorous online experiments conducted on the platform. More significantly, the new rebooking capability contributed an additional +1 percentage point (PPT) uplift in overall margin. These improvements translated to millions in additional revenue and profit across the $2 billion revenue base, demonstrating the substantial financial impact of sophisticated pricing optimization.

Technologies Used

The implementation leveraged advanced machine learning frameworks for real-time data processing and predictive modeling. Custom algorithms were built for dynamic pricing engines, personalization systems, and rebooking optimization. The technology stack included distributed computing systems to handle the scale of $2 billion in transactions, real-time analytics platforms for immediate pricing adjustments, and A/B testing infrastructure to validate pricing strategies through controlled experiments.

Our Team and Their Contributions

The pricing team operated as a strategic unit reporting directly to executive leadership, ensuring alignment between pricing optimization and business objectives. Team members contributed expertise in machine learning model development, real-time systems architecture, statistical analysis for experiment design, and business intelligence for performance monitoring. The collaborative approach between data science, engineering, and business strategy teams enabled rapid iteration and deployment of pricing innovations that directly impacted the bottom line.